In 2011, Hungary bit the bullet and began taxing sugar, fat, and caffeine, as a way for the government to take in some money for treatment of the damage caused by those substances. Several other European countries sat up and took notice. “Globesity—the Big Picture” had more to say about Hungary’s try at implementing a fat tax, and included brief remarks about the happenings in Denmark and a few other countries. “Globesity and Tax in the Far North” also talked about Denmark, as well as Finland. Bucking the worldwide trend, Norway and the Netherlands report relatively low rates of child obesity, and we looked at the measures that both countries are taking to keep their numbers low.

In 2011, Hungary bit the bullet and began taxing sugar, fat, and caffeine, as a way for the government to take in some money for treatment of the damage caused by those substances. Several other European countries sat up and took notice. “Globesity—the Big Picture” had more to say about Hungary’s try at implementing a fat tax, and included brief remarks about the happenings in Denmark and a few other countries. “Globesity and Tax in the Far North” also talked about Denmark, as well as Finland. Bucking the worldwide trend, Norway and the Netherlands report relatively low rates of child obesity, and we looked at the measures that both countries are taking to keep their numbers low.

The pioneers of psychedelic experience warned that “set and setting” are all-important, and the same seems to be true of the dining experience. “What’s Going On With Globesity?” discussed American and French mealtime habits and speculated on why the differences do seem to make a difference. Another post looked at what the World Health Organization found in Uzbekistan.

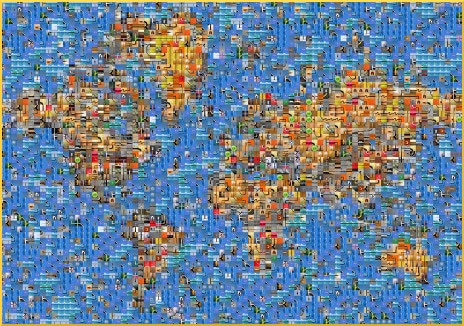

The Big Obesity Picture

A page at Vox.com offers “21 maps and charts that explain the obesity epidemic,” and two of them are pertinent to the global situation. Item #9 is a World Health Organization map whose color coding makes it easy to see where the epidemic is worst. It includes the disheartening news that obesity worldwide has nearly doubled since 1980. This is balanced by Item #21, a chart from The Lancet showing that obesity rates seem to have stabilized in recent years. The accompanying explanation, however, is not reassuring:

Exactly why this has occurred remains a scientific mystery, but researchers think it’s the impact of some combination of changes in policy, increased awareness about healthy lifestyles, and the attention that has been paid to stopping obesity in early childhood.

The world also contains many encouragers and enablers of obesity, and most of them have the word “corporation” in their names. Financial speculators who want guaranteed returns on their investments are advised to buy shares in companies that sell food, beverages, pharmaceuticals, diet and nutrition products, sports clothes and gear, and basically any weight-loss or healthcare services.

Just to break it down a little, Moneyweb reports that in 2013, the purveyors of supplemental vitamins and minerals did $35 billion worth of business, while the world’s gyms and health clubs took in $78 billion and the athletic and apparel industry made a staggering $365 billion.

Who would look at the global obesity epidemic and think, “A Fat Investment Opportunity?” A corporation would. Hanna Berry says this:

There are plenty of potentially lucrative opportunities for investors looking to “play the global fight against obesity theme,” according to Bank of America Merrill Lynch… The US-based wealth and banking group notes that the global health and wellness food market is estimated at $932 billion…Quoting Euromonitor, it says the industry is both “high growth and high margin” and is set to reach $1.1 trillion by 2019.

Your responses and feedback are welcome!

Source: “21 maps and charts that explain the obesity epidemic,” Vox.com, 11/17/14

Source: “A fat investment opportunity,” Moneyweb.co.za, 04/16/15

Image by Kai Schreiber

FAQs and Media Requests:

FAQs and Media Requests: